Actionable Strategies for Effectively Managing Debt During Furlough

Actionable Strategies for Effectively Managing Debt During Furlough

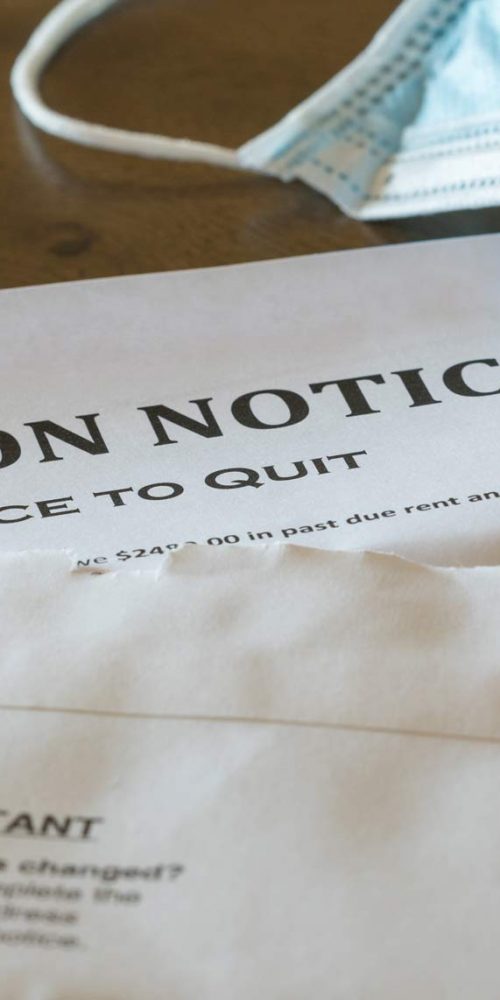

The COVID-19 pandemic has profoundly affected the UK economy, leading to widespread furloughs and layoffs across numerous sectors. As a result, many individuals are grappling with significant financial challenges and the burden of managing existing debts while experiencing a decrease in income. If you find yourself in a prolonged furlough situation, tackling your debts may feel overwhelming, particularly if you're receiving only 80% of your normal salary. However, with the right strategies in place, it is entirely possible to navigate this financial landscape, effectively manage, and even eliminate your debts. Here’s how you can take proactive steps to regain control over your financial situation during these challenging times and work towards recovery.

1. Develop a Tailored Monthly Budget Reflecting Your Current Income Changes

Start by crafting a personalized monthly budget that genuinely reflects your current financial reality. This budget should accurately incorporate your reduced income and highlight your capacity to save effectively. Reevaluate your spending habits and consider reallocating funds from non-essential categories, such as entertainment, dining out, and luxury items, towards your critical bills and savings. By prioritizing your financial obligations and cutting back on discretionary expenses, you can create a sustainable budget that not only helps you manage your debts more effectively but also prepares you for any potential financial hurdles in the future. This disciplined approach can lead to increased financial stability over time.

2. Explore Additional Income Opportunities to Mitigate the 20% Pay Cut

To meet your debt repayment obligations, it’s vital to explore ways to compensate for the 20% reduction in salary. Look for alternative income streams, such as freelance projects or part-time employment, and consider reducing your expenses by canceling seldom-used subscription services or reassessing your grocery shopping habits. Implementing a cost-effective meal plan can significantly decrease your monthly expenditures. By actively pursuing these savings and additional income, you will be better positioned to meet your debt responsibilities and avoid falling behind during your furlough period, allowing you to maintain a sense of financial security.

3. Evaluate Debt Consolidation Loans to Streamline Your Payment Process

Consider the potential benefits of applying for debt consolidation loans for bad credit. These financial solutions can help simplify your financial obligations by merging multiple debts into a single, manageable monthly payment. This method can alleviate confusion surrounding various due dates and payment amounts, enabling easier financial planning. For those experiencing furlough, a debt consolidation loan can provide a structured framework to handle a limited income while reducing the stress associated with juggling multiple payments, ultimately aiding you in regaining your financial footing.

4. Strategize for Your Long-Term Financial Goals and Security

As you navigate your financial situation, reflect on your long-term aspirations, such as purchasing a home or launching your own business. Establishing these future objectives can inspire you to enhance your overall financial circumstances. A debt consolidation loan can also contribute to improving your credit score, thereby making it easier for you to qualify for a mortgage or business loan with more favorable interest rates. By planning strategically and working diligently toward your financial milestones, you can position yourself for success and ultimately achieve greater financial independence, leading to a more secure future.

For further assistance and expert advice on managing your finances during the pandemic, as well as understanding how debt consolidation loans can specifically benefit furloughed employees, reach out to Debt Consolidation Loans today for personalized guidance.

If you are a homeowner or business owner, connect with the experts at Debt Consolidation Loans today to discover how a debt consolidation loan can positively influence your financial health and stability.

If you believe a Debt Consolidation Loan aligns with your financial goals, don’t hesitate to contact us or call 0333 577 5626. Take the vital first step towards improving your financial situation with a single, manageable monthly repayment.

Discover Key Financial Resources for Expert Guidance and Support:

Consolidate My Medical Loan: Is It Possible?

Consolidate My Medical Loan: Is It Possible?

Is Consolidating Your Medical Loan a Viable Option?

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Postponed Until March: Essential Information You Should Know

Get Out of Debt Quickly: Effective Strategies to Consider

Get Out of Debt Quickly: Effective Strategies to Consider

Proven and Quick Strategies to Escape Debt Efficiently

Debt Consolidation Loans UK: Benefits and Drawbacks

Debt Consolidation Loans UK: Benefits and Drawbacks

In-Depth Look at the Benefits and Potential Drawbacks of Debt Consolidation Loans in the UK

Debt Consolidation Loan Calculator for Smart Financial Planning

Debt Consolidation Loan Calculator for Smart Financial Planning

Utilize Our Debt Consolidation Loan Calculator for Informed Financial Planning

The Article Furloughed and in Debt? Key Actions You Must Take Was Found On https://limitsofstrategy.com